I was recently asked during an episode of Stop the Sales Drop video panel titled: “Rebooting How Sales and Marketing Use Intent Data” about where intent data should be used in the buyer’s journey. My short answer: almost everywhere.

The long answer is far more helpful, but also…well, quite longer.

Intent data can support use cases from the very beginning of the buy-cycle all the way down to post-sale account expansion efforts. Pretty much any B2B marketing, sales, or customer success effort that relies on knowing when a company is “in market” to buy (or churn) and what they’re interested in will benefit from intent data.

I’ll break down all the various use cases by buyer’s journey stage in a later post. But first, you need to know where your target accounts are in their buyer’s journey so you can then select the right engagement tactics, messaging, and content.

How to Identify Where Prospects Are in the Buyer’s Journey

When using intent data to identify prospect journey stages, it’s vital to be strategic when selecting intent topics and/or keywords to monitor. Too often, B2B marketing and selling teams cursorily chose topics/keywords, and then simply prioritize any account that spikes on a few of those terms.

While this may help ensure you’re only focusing on in-market accounts, you’ll end up wasting a major portion of intent data’s potential value: its ability to highlight where prospects are in their journey, so you can select the right combination of tactics and messages to use for each in-market account.

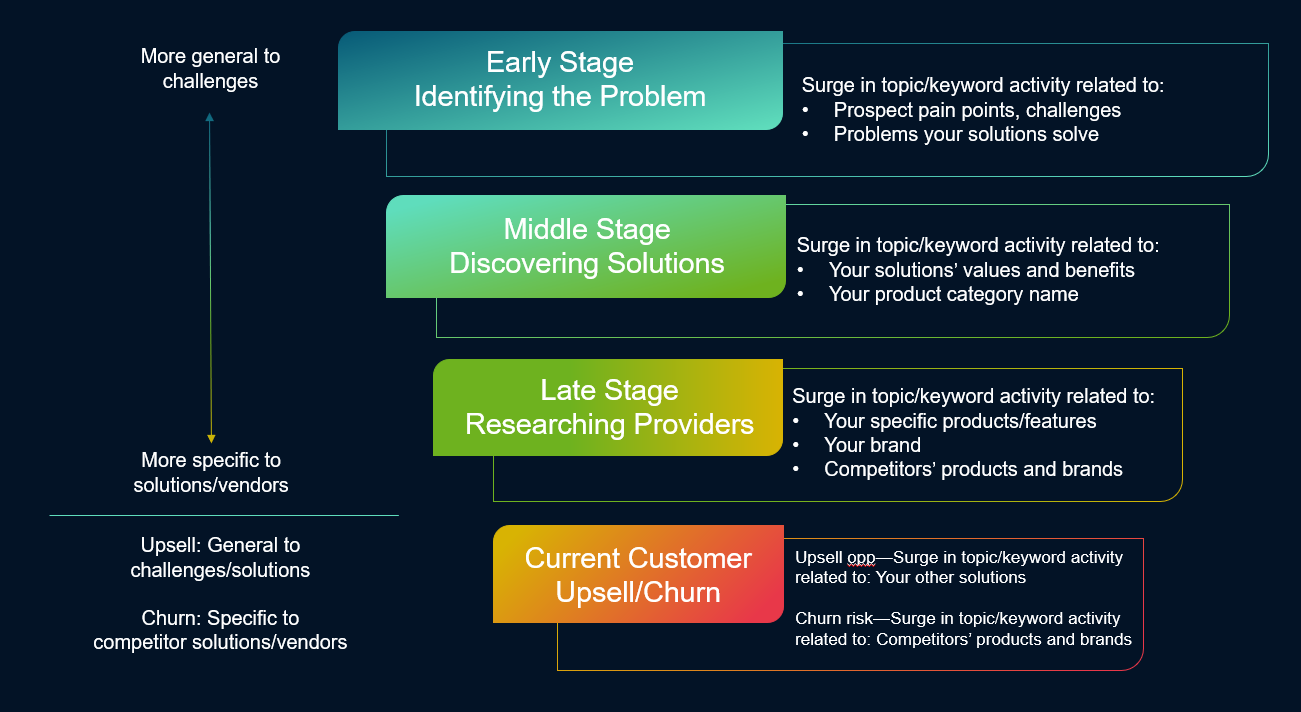

Analyzing the intent signals of your target accounts as they relate to specific types of topics or keywords can indicate their buy-cycle stage.

Identifying Early-Stage Prospects

It’s usually safe to assume that prospects early in their buyer’s journey aren’t yet aware of your solution, let alone your brand (unless you’re a well-established company with a high-level of market share). Early-stage research typically consists of prospects trying to better understand any issues they’re having and how they can solve them.

As a result, intent data signals will surge around topic/keywords related to general challenges and pain points your prospective customers feel as well as the general solution your products/services provide.

For example, let’s say you’re marketing a Learning Experience Platform that helps businesses increase their employees’ knowledge and skills. Prospective customers that are early in their buyer’s journey will be seen spiking on topic/keywords like: “employee education,” “subject-matter expertise,” “professional development,” “training and development,” and “training materials and methods.”

Notice that these aren’t specific to product categories, but rather general needs. That’s how you know they’ve just begun their research into potential solutions.

Identifying Mid-Stage Prospects

By this stage, prospects have likely identified why they’re having problems. Now they’re focused on finding solutions. This means the intent data will show a greater level of activity around topics/keywords related to specific product/service categories.

Continuing with our Learning Experience Platform example, you may see a lot of activity around topics/keywords similar to: “Instructor-Led Training (ILT),” “eLearning,” “Optional Practical Training (OPT),” and, definitely, “Learning Experience Platform.”

Identifying Late-Stage Prospects

Understanding the types of available solutions, your target accounts are now getting ready to make decisions. They’re trying figure out whether investing in a solution is worth the cost, and if so, which vendor they should select.

Consequently, intent signals will be more heavily focused on topics and keywords related to:

- Your company’s brand (e.g., “Docebo” or “Cornerstone”)

- Your company’s specific product names (e.g., “Docebo Learning Suite” or “Cornerstone Learning”)

- Your product features (e.g., “Social learning,” or “Mobile learning); and

- Your competitors’ brand and product names.

Identifying Current Customer Expansion Opportunities or Churn Risks

Beyond the buyer’s journey, intent data has enormous value for account expansion and retention. Intent signals related to specific topic and keyword types will tell you whether current customer accounts are ripe for upsell or a churn risk.

If an expansion opportunity exists, intent signals will likely surge on topics/keywords related to solutions you offer, but the customer hasn’t yet invested in. These may comprise any combination of topics/keywords in the stages discussed above.

On the other hand, you can identify customer churn risks when current accounts’ research is spiking on a combination of topics/keywords related to brands and product names competing with the solution they’ve already bought from you.

For a deeper dive into using intent data to identify where your prospective customers are in their buyer’s journey—as well as how to select the right topics/keywords and segment target accounts accordingly—check out Intentsify’s ebook: Activating Intent Data: Understanding, Selecting, and Monitoring Topics and Keywords.