The BDR Use Case: 4 Ways To Scale Intent Data’s Impact On Pipeline

Intent Data | Demand Generation | January 13, 2021 | by David Crane

Click here to listen to the article

A version of this article was originally published on CMSWire

As far as intent data use cases go, leveraging intent to support business-development efforts (or sales-development efforts) may be the most common—even among B2B marketing teams, which are increasingly overseeing the business-development role.

According to a recent TOPO survey, “Selecting or prioritizing accounts” is the No.1 use case, while “Sharing insights with sales or sales development” is ranked at No.2.[1] Similarly, a recent DemandGen Report survey puts using intent data to “inform sales/sales enablement” at the No.2 use case.[2]

Despite the popularity of intent data among business-development and sales-development reps (BDRs and SDRs, respectively), data shows room for improvement regarding how it’s being leveraged. According to the DemandGen Report survey, 29% of those surveyed said fueling “BDR outreach with insights” was the biggest impact on conversion, behind four other use cases. This isn’t a terrible figure, but it isn’t great either.

While it’s difficult to say exactly why the impact isn’t more pronounced, the fact that the four other use cases topping BDR outreach are owned entirely by marketing implies BDR/SDR education around using intent data is what’s failing.

For that reason, here are four intent data “best practices” for the business-development use case.

1. Use Intent Signals to Select the Right Follow-Up Messages

The successful use of intent data goes well beyond simply prioritizing accounts for follow-up. The most effective BDR teams analyze account activity around specific topics and keywords to understand which messages are most likely to resonate with contacts at those accounts.

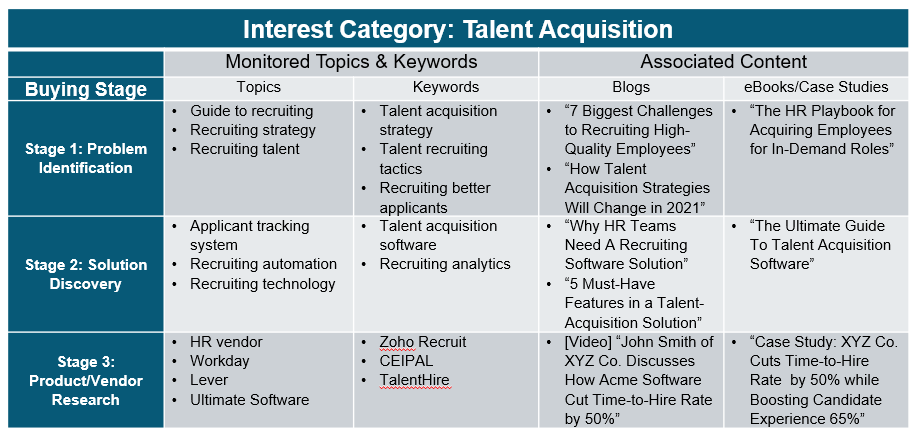

BDRs should have access to a table connecting intent-monitored topics and/or keywords to specific messages and pieces of content. (See example table below.) This will help ensure follow-up efforts align with prospects’ research interests, concerns, and needs. This is even true if a specific contact was nurtured through an email track differing from what the intent data says. The more account research information you have at your disposal, the better your conversations will be.

2. Analyze Topic/Keyword Activity to Identify Buying Stage

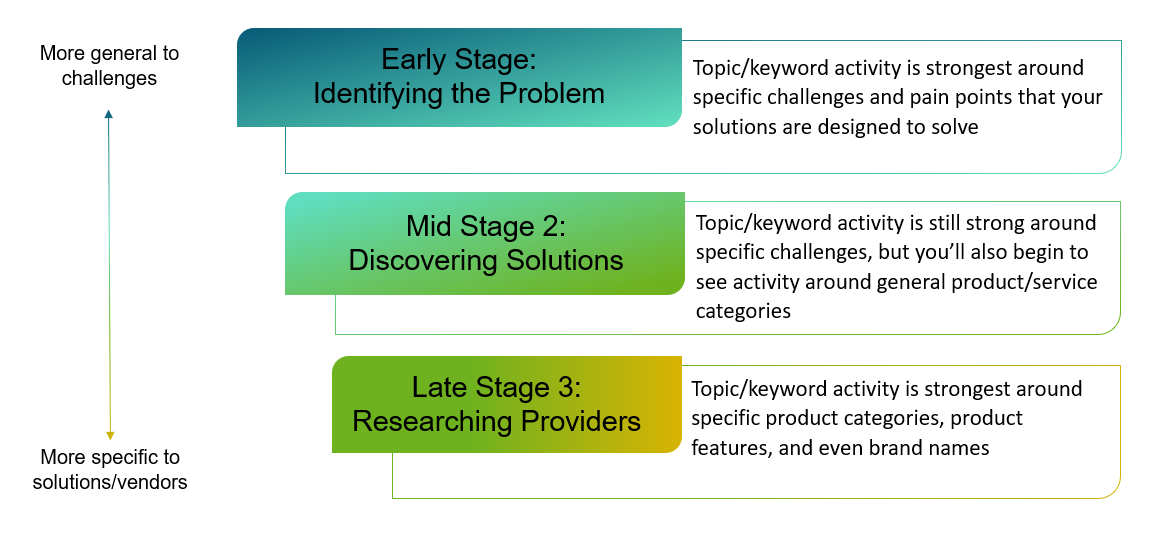

This isn’t always easy, but if you’re monitoring the right topics and keywords (and I highly recommend tracking both), you can get a strong idea of where target accounts are in their buyer’s journey. In general, prospects’ progression through the buy cycle results in the following evolution in topic/keyword activity. (See diagram below.)

Knowing where target accounts are in their buyer’s journey allows you to both better prioritize accounts (and leads among these accounts) and further customize follow-up messaging. For example, mid-stage prospects likely need information about how your solutions can help solve their problems, while late-stage prospects want to know why they should buy from you rather than your competition.

3. Understand the Importance of Geographic Data

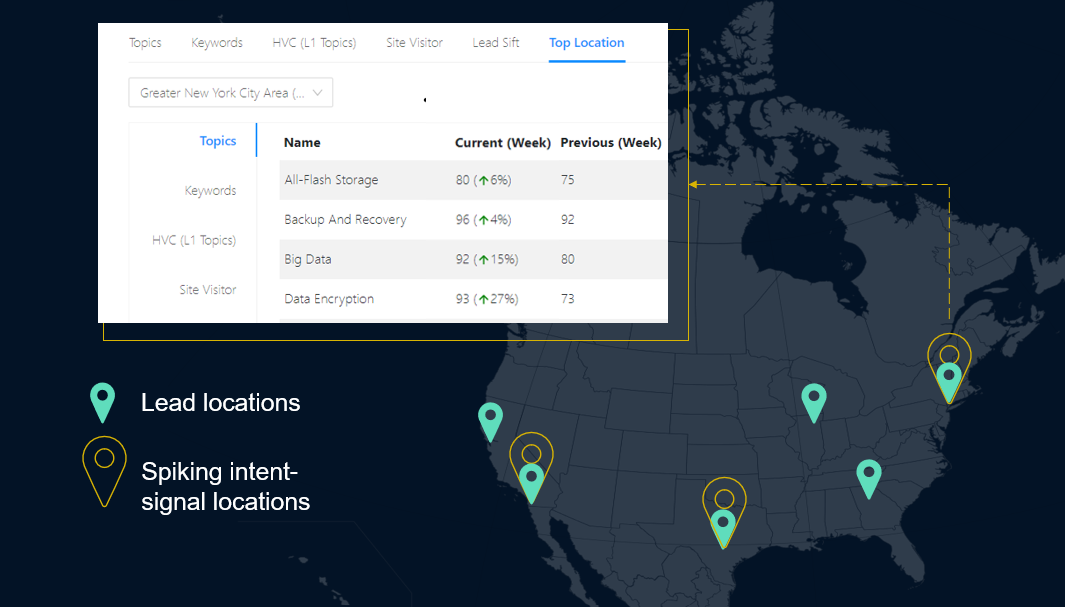

It’s important to always reference a contact’s location against the location from which the account-level intent signals are originating. This is especially true for enterprise target accounts, because buying committees are more likely to be localized to specific offices.

If a target account is showing significant intent activity from a specific geo location, but your contact (or lead) is in a different locality, it’s less likely that that person is part of the buying group showing intent. Thus, the signals around particular topics and/or keywords (and the messages you’d use for them) may not apply to that individual.

4. Reference 3rd-Party Intent Signals Against Your Website Visitor Activity

If you have a solution that monitors your website activity, be sure to cross reference this information with your target accounts’ external online research behaviors. (Note: Intentsify’s Intent Activation™ solutions include website tracking for free.)

Similar to intent activity around product- or brand-focused topics/keywords, when individuals engage with your website, this typically indicates they’ve passed the initial buying stages of “Identifying a problem” and on to “Discovering solutions” or even “Researching providers.” BDRs should prioritize these accounts and select late-stage messaging.

Intent data offers the versatility to support numerous use cases throughout the buyer’s journey. It improves marketing, sales, and customer success results. But intent data’s impact on each function depends greatly on its users understanding exactly how it should be leveraged for their specific use case. And while helping BDRs prioritize which accounts to focus on is helpful, it merely scratches the surface of what intent data can do to help BDRs create valuable sales opportunities.

[1] TOPO, Intent Data Market Guide Webinar, May 19, 2020: https://webinars.topohq.com/intentdataguide/

[2] https://www.demandgenreport.com/resources/reports/intent-data-it-s-becoming-a-key-ingredient-for-revenue-growth